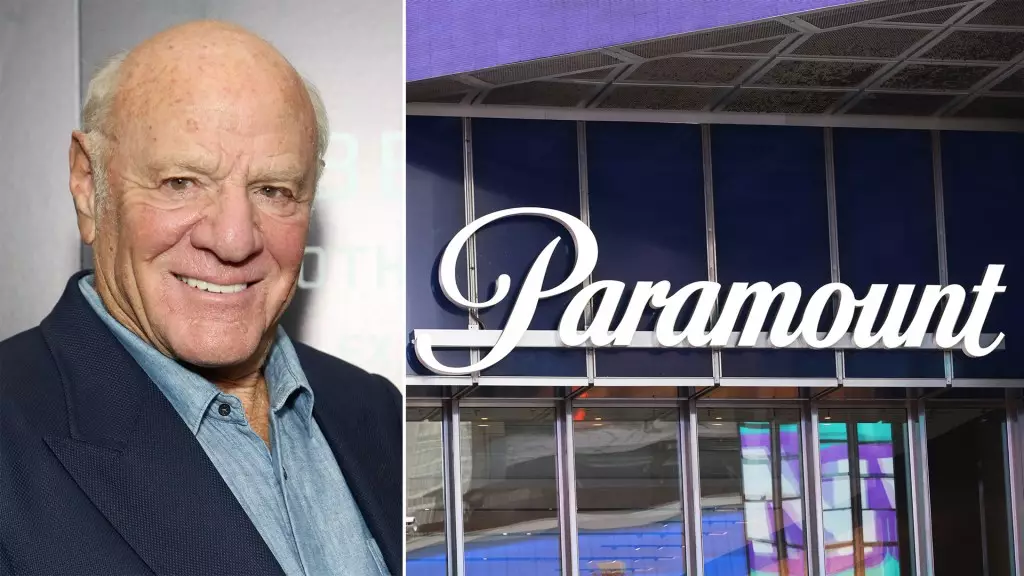

Barry Diller, the media mogul, is reportedly considering a bid for Paramount, as reported by The New York Times. Through his company IAC Corp., Diller has engaged in nondisclosure agreements with National Amusements Inc., Paramount’s controlling stakeholder. This move signifies Diller’s interest in taking control of the company, which has been at the center of various acquisition talks in recent times.

The Paramount sale saga has seen several potential suitors, including Sony, Edgar Bronfman Jr., and an investor group led by Steven Paul. While talks with David Ellison’s Skydance were close to a deal before falling apart, Diller’s interest adds a new dimension to the ongoing discussions. Notably, only Skydance and Apollo Global Management had previously discussed a full takeover of Paramount, with other parties exploring options to gain majority control without a complete acquisition.

Paramount’s recent struggles are evident in its falling stock price, which hit a record low following the 2019 Viacom-CBS merger. The company’s CEO, Bob Bakish, was ousted in April, leading to an unconventional setup with a trio of executives sharing responsibilities. Despite these challenges, the newly appointed co-CEOs remain optimistic about the future and have outlined a strategic plan for growth.

As Paramount navigates through this period of transition, the involvement of Barry Diller brings a mix of experience and digital media focus to the table. With key executives taking charge and a clear vision for the company’s future, Paramount is poised to overcome its current obstacles and position itself for success in the ever-evolving entertainment industry.

While the uncertainty surrounding the Paramount sale saga persists, the potential bid from Barry Diller hints at a new chapter for the iconic company. As discussions unfold and strategic plans take shape, Paramount aims to emerge stronger and more competitive in the dynamic landscape of the entertainment business under new leadership.