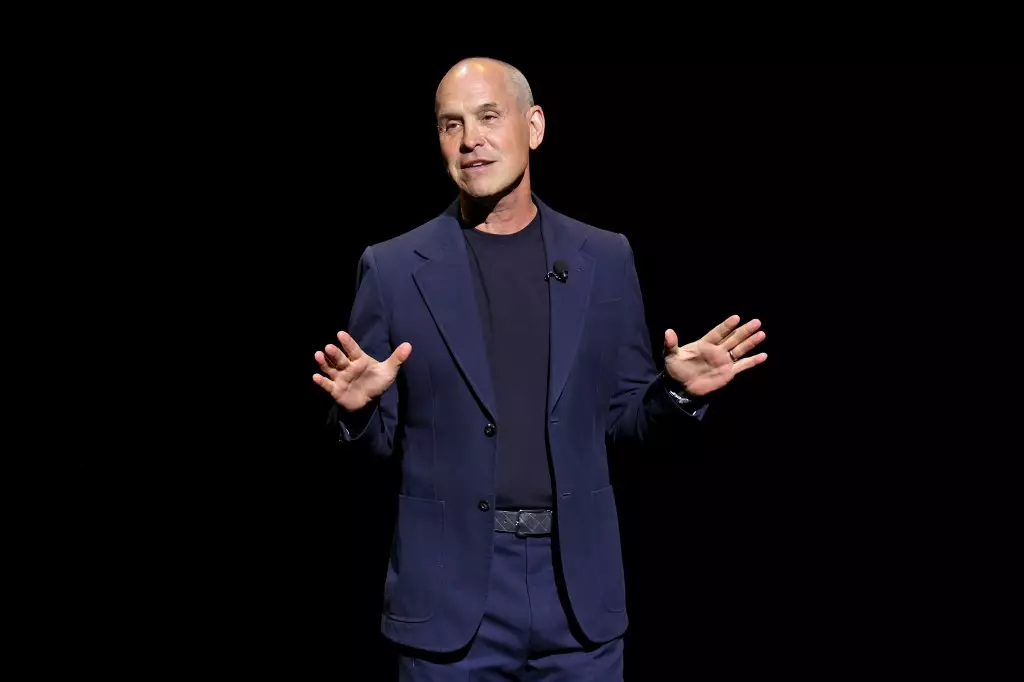

When faced with the possibility of a takeover, it can be easy to feel overwhelmed and stressed. However, Paramount Pictures CEO Brian Robbins demonstrates a different approach by making light of the situation. By joking about his colleague raising money through Kickstarter to bid for the studio, Robbins shows a sense of humor and resilience in the face of uncertainty.

Despite the ongoing negotiations with Skydance Media, Paramount Pictures is not slowing down in terms of announcing new projects. From a Trey Parker-Matt Stone original live-action comedy to a G.I. Joe Transformers crossover, the studio is showcasing a diverse range of upcoming films. Additionally, with the announcement of an R-rated live-action Teenage Mutant Ninja Turtles movie and a reboot of The Running Man, Paramount is demonstrating its commitment to providing a variety of content for audiences.

The potential takeover of Paramount Pictures by Skydance Media involves complex financial arrangements. Skydance is reportedly offering $2 billion to buy out Redstone’s stake in NAI, with David Ellison looking to acquire Skydance in a separate all-stock deal worth $5 billion. These financial moves have generated backlash from other shareholders who feel that Redstone stands to benefit while others are left with little compensation.

The possible takeover of Paramount Pictures has sparked mixed reactions within the industry. While some see the potential acquisition as a way to inject new life into the studio, others are concerned about the implications for the company’s future. With Paramount board members rumored to be stepping down and ongoing financial challenges, the outcome of the takeover remains uncertain.

As the negotiations between Paramount Pictures and Skydance Media continue, the future of the studio hangs in the balance. Whether the takeover leads to a revitalization of Paramount or further financial struggles remains to be seen. One thing is clear – the entertainment industry will be closely watching the developments surrounding this potential acquisition.